Vakrangee, Transunion CIBIL tie up for cibil score and report

It is startling to know that nearly 67% of people in India are more than ready to take loans to meet their financial needs. However, to avail of a loan, you will have to prove that you have good creditworthiness and maintain good financial health. These two factors can be checked through your CIBIL score. Earlier, the process of checking CIBIL scores used to be quite complex that involved a series of steps.

Now, the process of checking your CIBIL score has been made easier. This is because of the partnership between Vakrangee and TransUnion CIBIL (TUCIBIL). They aim to boost financial inclusion and make the process of checking CIBIL scores easy. Besides, this partnership also allows people in rural areas to avail bank loans.

What is CIBIL score?

These days, many turn towards loans and credit cards for their financial purposes. To avail of this credit, the CIBIL score is important. In simple terms, the CIBIL (Credit Information Bureau India Limited) score is an individual’s credit score. This score shows the credit history of an individual thereby speaking sounds of a person’s credit profile. Past credit of a person such as debt, borrowing, and repayment is primarily considered while calculating the CIBIL score.

This past behavior is considered to be an indicator for future actions. This is the reason why financial institutions like banks check for your CIBIL score before granting a loan. So, ensure that you maintain a good CIBIL score so that you are eligible for a loan whenever needed. It is also a best practice to check your CIBIL score regularly in case you use credit cards or have an existing loan.

How can you check your CIBIL score?

It’s recommended to check your CIBIL score often. You can check your score in several ways. Whereas, the most common as well as the easiest way to check your CIBIL score by PAN card. With the Vakrangee-TransUnion CIBIL partnerships, once a business or an individual places a request for their CIBIL score, they will be provided with the same on a secure service portal through Nextgen Vakrangee Kendra.

Tips on how to increase CIBIL score

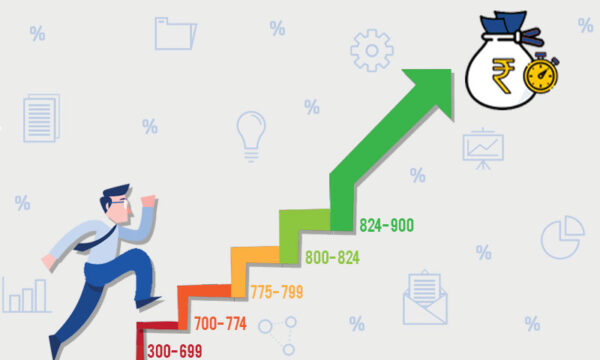

Typically, ensure that you maintain your CIBIL score above 750. For many people, increasing their CIBIL score even by 100 points in a month may not be possible as it typically takes between 4 and 12 months depending on your current financial situation. However, if you repay a large debt, pay your bills on time, and repay your credit card bills, your chances may improve.

In case your CIBIL score is lesser than this recommended score, here are some tips on how to increase your CIBIL score.

- Repay all of your credit card dues and ensure you do not go beyond the due date.

- Keep your credit card utilization to a minimum.

- Regularly check your credit report.

- Ask for a higher credit limit.

- Purchase new credit cards.

- Repay a large sum of debt.

Conclusion

Keeping a check on your CIBIL score is important if you want to avail any loans in the future. You can check your CIBIL score by PAN card and understand more about your CIBIL score on the Finserv MARKETS website. Maintaining a high CIBIL score can prove you eligible for a personal loan. You could avail any kind of personal loan such as a student loan, auto loan, etc. at a reasonable interest rate and accomplish your goals. Besides, you can also avail any kind of loan based on your requirements from Finserv MARKETS.