Navigating High Risk Merchant Accounts: A Comprehensive Guide to HighRiskPay.com in 2023″

Navigating High Risk Merchant Accounts: A Comprehensive Guide to HighRiskPay.com in 2023″

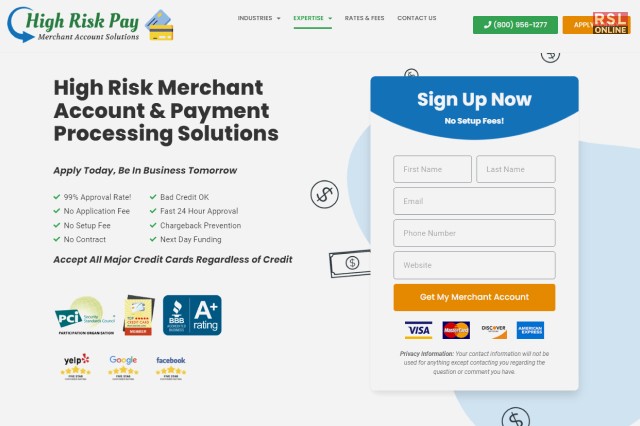

If you’re involved in a high-risk business, chances are you’re familiar with the reputable High-Risk Merchant account provider, highriskpay.com.

This longstanding company specializes in offering merchant account services to businesses operating in high-risk industries or those with a history of financial challenges. Whether your company has faced credit issues in the past or operates in a high-risk sector,

High-Risk Pay is dedicated to providing offshore and high-risk merchant accounts. Stay tuned as we delve deeper into the details of this company in the following paragraphs.

See also : “Sam Bahadur: A Legendary Tale Unveiled on ZEE5”

High Risk Merchant Account Highriskpay.Com Overview

| Name | High Risk Pay |

| Industry | Accounting, Financial Services |

| Founded | 2 April, 1997 |

| Company Type | Private |

| Operating Status | Active |

| Headquarters | Greater Los Angeles Area, West Coast, Western US |

| Phone Number | 800-956-1277 |

| Email ID | [email protected] |

| Website | highriskpay.com |

What Is High Risk Merchant Highriskpay.Com?

Since its establishment in 1997, High-Risk Pay has emerged as a leading player in the credit card sector, experiencing remarkable growth. With a focus on high-risk merchant accounts, their mission centers around customer satisfaction and being a reliable service provider.

The company facilitates the connection of merchant accounts to trusted credit card processing solutions through an extensive national network and processing banks. Offering competitive rates, they strive to support their clients in maintaining thriving businesses. What sets them apart is their commitment to providing live customer assistance around the clock, contributing to their widespread popularity.

High-Risk Pay’s nationwide network ensures secure connections between merchant accounts and processing banks through a trusted credit card processing solution. Their affordable rates empower merchants to run successful businesses while offering convenient card payment options to customers.

Typically catering to merchants involved in high-volume credit card transactions, such as those related to sporting events or concert tickets, retail businesses, offshore accounts, or unconventional credit payment methods like mail or telephone orders, High-Risk Pay serves a diverse range of clients in the high-risk industry.

What Is A High Risk Merchant Account?

Despite being labeled as a high-risk business by a previous processor or payment service provider, a high-risk merchant account serves as a specialized business bank account established by a payment processor to facilitate the acceptance of credit and debit cards for merchants.

The term “high-risk merchant account” may not be familiar to most business owners unless their company has already been categorized as such. Initially, it might appear as if it’s a direct critique of your business or entrepreneurial skills.

High Risk Pay is here to clarify that this designation rarely stems from personal factors. In reality, it is highly quantitative and unrelated to how you manage your business.

Any business, whether operating online or offline, that engages in specialized markets is considered a high-risk merchant. This category encompasses niche verticals like travel agencies, adult retailers, dating services, SaaS suppliers, gun dealers, and more.

Who Needs To Use High Risk Pay?

If your business operates on a large scale or falls within a high-risk industry, you likely require assistance in processing credit card payments. Our services cater to a diverse range of businesses seeking high-risk merchant accounts. Leveraging our expertise, we specialize in addressing the needs of companies with offshore or international interests, owners with poor credit histories, or any other challenges hindering them from accepting credit card payments.

Creating a high-risk merchant account on HighRiskPay.com is a straightforward process. Once approved, businesses can start accepting credit card payments within 48 hours. Recognizing the vital importance of credit card transactions for businesses, especially those in high-risk sectors, we ensure a seamless and routine process for our clients.

Industries Related To High Risk Merchant Highriskpay.Com

If you want to know what are the types of industries that use this platform I am here to help you out! Take a look at this look to know better:

- Adult Merchant Account

- Debt Collection Merchant Account

- Bad Credit Merchant Account

- Continuity Subscription Merchant Account

- CBD Merchant Account

- Credit Repair Merchant Account

- E-commerce Merchant Account

- Dating App Merchant Account

- Firearm Merchant Account

- Online Pharmacy Merchant Account

- MLM Merchant Account

- High Volume Merchant Account

- Tickets brokers Merchant Account

- Tech Support Merchant Account

- Startups Merchant Account

- Travel Merchant Account

- Nutraceutical Merchant Account

- Sportsbook Merchant Account

- Nonprofits Merchant Account

- Dropshipping Merchant Account

What Is The Expertise?

HighRiskPay.com not only offers a multitude of services but also showcases notable expertise in several key areas:

- ACH Processing: HighRiskPay.com excels in Automated Clearing House (ACH) processing, ensuring the seamless handling of electronic check transactions. This feature is particularly beneficial for businesses operating in high-risk industries.

- Instant Approval: A standout feature contributing to High Risk Pay’s popularity is its swift approval process. Applicants can expect nearly instant approval, streamlining the onboarding experience.

- Chargeback Prevention Program: HighRiskPay.com provides a robust Chargeback Prevention Program, leading to an impressive 86% reduction in chargebacks. The system issues immediate alerts whenever cardholders dispute transactions, serving as an effective measure to mitigate fraud, scams, and recover potentially lost sales.

High Risk Merchant Account Highriskpay.Com Pricing