Rajkotupdates news :the Harshad Mehta Bull Run: A Financial Rollercoaster

Harshad mehta bull run rajkotupdates news :

Introduction

Harshad mehta bull run rajkotupdates news : few events have left as indelible a mark as the Harshad Mehta Bull Run. This rollercoaster ride through the Indian stock market of the 1990s is a tale of intrigue, manipulation, and soaring ambitions. In this article, we’ll delve into the fascinating story of the Harshad Mehta Bull Run, dissecting its causes, consequences, and lessons for investors.

Also read : https://inewstelegraph.com/us-inflation-jumped-7-5-in-in-40-years-rajkotupdates-news/

The Rise of a Maverick

Harshad Mehta: The Man Behind the Legend

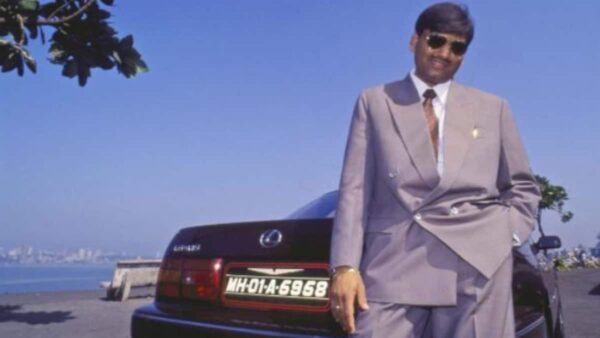

The story begins with Harshad Mehta, a stockbroker with extraordinary vision and audacity. Hailing from modest beginnings, Mehta quickly gained prominence in the Bombay Stock Exchange. His unorthodox tactics and uncanny ability to manipulate the market earned him the moniker “The Big Bull.”

The Bull Run Ignites

In the late 1980s, Mehta initiated a series of bold moves that set the stage for the infamous bull run. His strategy involved exploiting loopholes in the banking system to secure massive loans. With these funds, he manipulated stock prices, triggering a surge in the market that seemed unstoppable.

The Meteoric Ascent

Domino Effect on Stocks

The Mehta phenomenon had a domino effect on stock prices across sectors. Companies with little fundamental strength saw their shares soaring to unprecedented levels. Investors, mesmerized by the rising numbers, jumped onto the bandwagon, fearing they might miss out on the windfall.

The Role of Media and Speculation

Media sensationalism and speculative fervor further fueled the bull run. Headlines of astronomical gains seduced even cautious investors into the frenzy. The stock market became a stage for speculative gambling rather than rational investment.

The Icarus Effect

The Fall from Grace

As the adage goes, what goes up must come down. The Harshad Mehta Bull Run came crashing down as abruptly as it had soared. A series of events exposed Mehta’s financial manipulations, leading to a market meltdown that wiped out fortunes overnight.

Lessons Learned

The Harshad Harshad mehta bull run rajkotupdates news :Mehta saga left behind valuable lessons for investors and regulators alike. The importance of transparency, vigilance, and robust regulatory mechanisms became painfully evident. The incident prompted reforms aimed at fortifying the financial system against such manipulations.

Relevance Today

Parallels in Modern Markets

While decades have passed since the Harshad Mehta episode, echoes of the past continue to reverberate in modern financial markets. Instances of market manipulation and speculative bubbles still occur, underscoring the enduring relevance of the lessons from the past.

Navigating the Market Wisely

Investors today must approach the market with caution and a well-informed strategy. The allure of quick gains can blind even seasoned investors to potential pitfalls. By heeding the lessons from history, we can make more informed and prudent investment choices.

Conclusion

rajkotupdates news : Bull Run remains a captivating chapter in financial history, reminding us of the intoxicating allure of financial success and the perilous consequences of unchecked ambition. The saga underscores the importance of ethical conduct, transparency, and robust regulation in maintaining the integrity of financial markets.

FAQs

-

What triggered the Harshad Mehta Bull Run?

- The bull run was ignited by Harshad Mehta’s manipulation of stock prices through Harshad mehta bull run rajkotupdates news :banking system loopholes.

-

How did media contribute to the frenzy?

- Media sensationalism and speculative reporting hyped up the market, luring more investors into the speculative bubble.

-

What were the repercussions of the bull run’s collapse?

- The collapse led to a market meltdown and exposed vulnerabilities in the financial system, prompting reforms.

-

Are there parallels between the Mehta episode and modern markets?

- Yes, instances of market manipulation and speculative bubbles continue to occur, highlighting the relevance of past lessons.

-

What lessons can investors draw from the Harshad Mehta Bull Run?

-

Investors should prioritize transparency, ethical conduct, and regulatory oversight to avoid falling prey to similar market manipulations.